Philanthropy in India is very much in recent news [blog on IBSA for example]. A survey released last September by U.K.-based Charities Aid Foundation listed India 134th among 153 countries ranked by giving and volunteerism, excluding the much undocumented philanthropy that occurs in India. Recently, Arpan Sheth from Bain & Company examined the philanthropic chain of stakeholders in India, comprised of 3 major groups: donors, supporting networks and charity organizations/grassroots nonprofits. Individual and corporate donations compose 10% of charitable giving in India, while the Indian government and international organizations are responsible for the balance.

Philanthropy in India is very much in recent news [blog on IBSA for example]. A survey released last September by U.K.-based Charities Aid Foundation listed India 134th among 153 countries ranked by giving and volunteerism, excluding the much undocumented philanthropy that occurs in India. Recently, Arpan Sheth from Bain & Company examined the philanthropic chain of stakeholders in India, comprised of 3 major groups: donors, supporting networks and charity organizations/grassroots nonprofits. Individual and corporate donations compose 10% of charitable giving in India, while the Indian government and international organizations are responsible for the balance.

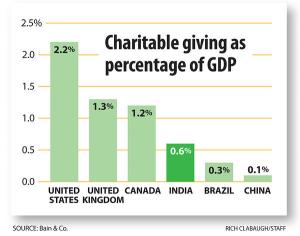

Although lagging in charitable giving when compared to developed nations, India is ahead of other developing countries. This is illustrated by Bain analysis which shows that in 2006 India?s charitable giving equaled almost $5 billion, expanding to $7.9 billion in 2009 (based on GDP figures if the rate of giving remained constant) and totaling 0.6% of India?s GDP. When compared to countries such as China and Brazil, whose charitable giving is totaled at 0.3% and 0.1% respectively, India is ahead. When juxtaposed to the United States with charitable giving totaled at over $300 billion, or approximately 2% of GDP, India is far behind. What issues then are preventing India from reaching giving levels of at least 1%, as in more developed economies such as the US and the UK? According to Sheth, India?s giving is similar to that of China, where the government is responsible for the majority of all giving. In the US, individual donors are responsible for approximately 75% of all giving; hence India must take a parallel approach to the US in developing its individual giving sector.

In India, 40% of the countries? wealth is controlled by the top 5% of India?s households. There are currently over 115,000 high net worth Indians today, yet when looking at the generosity of these individuals, it remains that giving does not increase with wealth and education. In fact, when giving is examined as a percent of household income, donations by the wealthy decrease. To understand what impedes giving amongst the wealthiest households in India, Sheth discusses 3 constraining factors.

Despite the growing increase in the number of wealthy individuals in India, this new accumulation of wealth appears to pose as a restriction in philanthropy. Paradoxically, a Bain analysis of 30 high net worth individuals in India showed that on average wealthy individuals contributed one-fourth of 1% of their net worth. Bain believes this is because ?many of those with hard-earned wealth are not eager to part with even a small amount of their money.? Another restriction lies within the common belief by donors that support networks and organizations are unprofessionally managed, instigating feelings of misused money amongst donors. Lastly, for many wealthy individuals there is a thin line between personal giving and corporate social responsibility initiatives. ?As most of corporate India is run by family owned groups, families tend to view corporate responsibility as ?extensions of their own giving?, which may lead to less in direct philanthropy.

To increase individual giving in India, Sheth first states that nonprofits must earn the trust of the public by establishing themselves as professional institutions. Donation support networks must increase their activities and efficiency which will stimulate donor giving.? Yet, Noshir Dadrawala, CEO of the Mumbai-based Centre for Advancement in Philanthropy admits that Indian law is ?not helpful? as nonprofits and grassroots are often hindered in development by various aspects of Indian life and outdated laws such as:

- Foreign Funds or operators must obtain a Foreign Contribution (Regulation) Act certificate that may take up to one year

- Donors who provide material goods receive no text benefits

- The cumbersome bureaucratic process required to obtain tax exemptions from the government hinders the smooth operations of NGOs

- The current tax deduction structure does not encourage donations. Current tax laws allow deductions of either 50% of the amount given or 10% of taxable income, whichever is lower. However there are exceptions where 100% deductions are available such as to relief funds established by the central and state government.

Dadrawala points out that another major dilemma is the lack of transparency amongst non-profits. Of the estimated 3.2 million non-governmental organizations in India, Dadrawala testifies that he has seen 60 that ?exhibit transparency and open financial reporting?.

Albeit India faces various hurdles in developing its philanthropy; the conditions and wealth in India are undeniably favorable to a booming philanthropic division. Sheth optimistically concludes that:

?I expect a culture of philanthropy to firmly take root in India. Our growing wealth will seed a new generation of professionally run institutions that foster giving. After all, India?s powerful economic engine is expected to produce thousands of millionaires in coming years. There is no reason why our wealthiest citizens should not do more for those with less. And they must. India needs their philanthropy. It?s a win-win.?

Source: http://globalprosperity.wordpress.com/2011/06/03/the-state-on-indian-philanthropy/

bipolar symptoms lotro boost mobile toysrus tupac shakur landmark urban meyer

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.